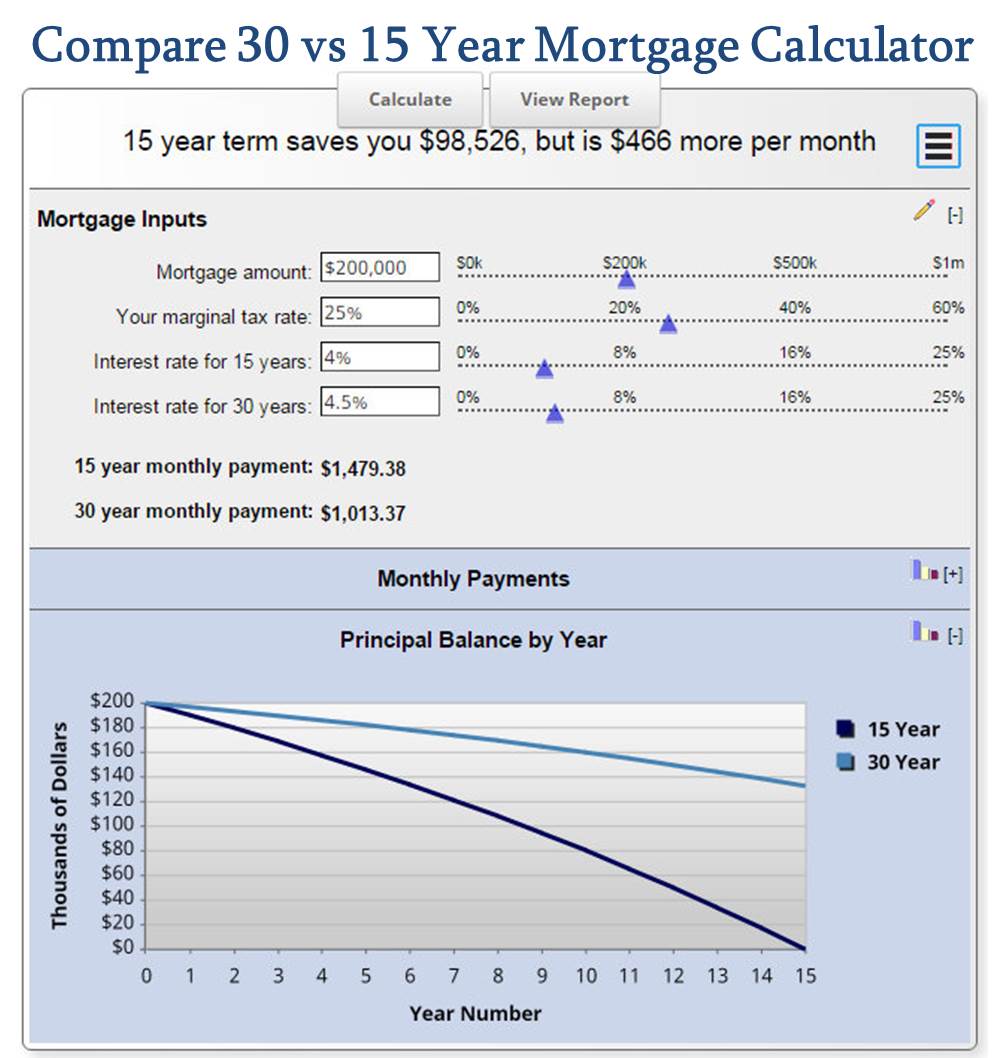

This will lower your monthly mortgage payments, although you will pay more in interest over the life of the loan.īuy points.Discount points, also known as prepaid points, help lower your interest rate, thus reducing your monthly mortgage bill. Lengthen the term of your loan.Choose a longer time period to pay off your mortgage, like 30 years rather than 15. A lower rate equals a lower monthly mortgage payment. Shop around for a lower interest rate.Different lenders offer varying interest rates. If you’ve crunched the numbers on a house you hope to buy but feel the monthly mortgage payments are higher than you’re comfortable with, don’t worry-there are ways to lower your mortgage payments. An adjustable-rate mortgage can be risky, but is an option to consider if you need a low interest rate loan and are planning to move before the interest rate adjusts. But after a certain time period, like five or 10 years, your interest rate (and monthly mortgage payment) may go up or down.

Adjustable-rate mortgage (ARM):These mortgages typically offer a lower interest rate than a fixed-rate loan, at least initially.This is ideal for home buyers who plan to stay put in the house for a long time, and prefer predictable payments that won’t change in the future. Here are the main types, and their pros and cons:įixed-rate mortgage:In a fixed-rate mortgage, your interest rate remains the same over the life of the loan. Mortgages come in a wide variety to suit home buyers’ circumstances. A credit score can range from 300 to 850 generally a high score means you'll have little trouble getting a home loan with great terms and interest rates.įor an instant estimate of what you can afford to pay for a house, you can plug your income, down payment, home location, and other information into a home affordability calculator. It’s based on whether you’ve paid your credit card bills on time, how much of your total credit limit you’re using, the length of your credit history, and other factors. Lenders will also review other aspects of your finances, including the following:Ĭredit score:Also called a FICO score, a credit score is a numerical rating summing up how well you’ve paid back past debts. As a general rule, to qualify for a mortgage, your DTI ratio should not exceed 36% of your gross monthly income. To calculate your DTI ratio, divide your ongoing monthly debt payments by your monthly income. Your debt-to-income (DTI) ratio is the percentage of gross income (before taxes are taken out) that goes toward your debt. Lenders will compare your income and debt in a figure known as your debt-to-income ratio. Lenders look closely at applicants who owe a large amount of debt, since it means there will be less funds to put toward a mortgage payment, even if their income is substantial. Lenders may check not only your income for the current year, but also for past years to see how steady your income has been.ĭebt:This is the total amount you owe to credit cards, car payments, child support, college loans, and other monthly debts. Your income:How much money you bring in-from work, investments, and other sources-is one of the main factors that will determine what size mortgage you can get. Here are the main things they review to determine how much you can borrow: When you apply for a mortgage to buy a home, lenders will closely review your finances, asking you to share bank statements, pay stubs, and other documents. land (where about one-third of Americans live) is located within USDA loan–eligible boundaries. While many assume USDA loans are just for farms or extremely remote areas, 97% of U.S. USDA loans:The United States Department of Agriculture offers loans in rural areas to borrowers with low to moderate incomes. In addition to putting no money down, borrowers also get lower interest rates and other fees. military (and qualifying family members) can get loans backed by the U.S.

0 kommentar(er)

0 kommentar(er)